List Of Realtor Tax Deductions

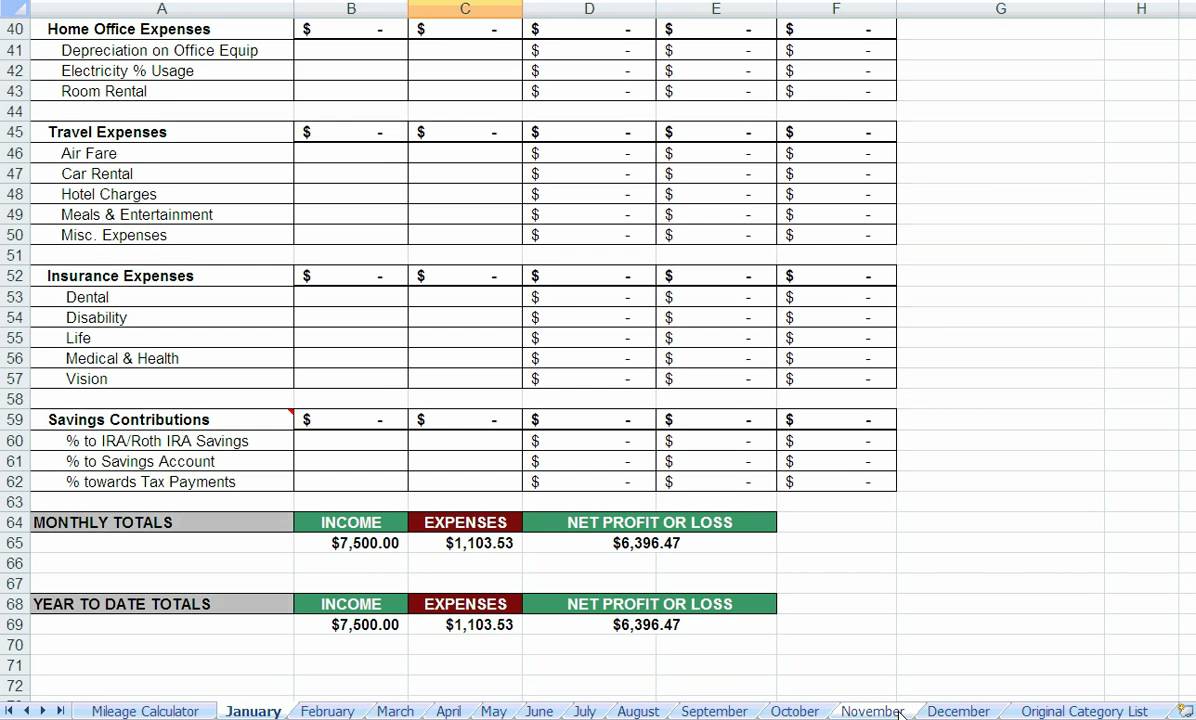

Realtor tax deductions and tips you must know Deductions deduction spreadsheet excel employed itemized expense sample crossword clue ufreeonline Tax spreadsheet expenses expense realtor estate real tracking agent business worksheet excel income purposes template sheet templates deductions itemized write

Self Employed Tax Deductions Worksheet — db-excel.com

Realtor itemized tax deductions.wmv Self employed tax deductions worksheet — db-excel.com Itemized tax deductions

Tax deduction spreadsheet then small business tax deductions — db-excel.com

Realtor tax deductions list realtor expenses smallTax deductions time estate real taxing doesn re professionals agents independent whether sure if not Tax worksheet deductions self business employed expenses expense spreadsheet taxes employment excel db se examples monthly worksheets article augustTax time doesn’t have to be taxing…100+ deductions for.

Tax worksheet deduction itemized deductions spreadsheet business value clothing donation expense irs guide self unique employed personal worksheeto excel viaTax excel spreadsheet intended for spreadsheet for taxes template Cheat sheet of 100+ legal tax deductions for real estate agentsTax deduction cheat sheet for real estate agents — db-excel.com.

Tax deduction spreadsheet throughout tax deduction cheat sheet for real

Deduction deductions spreadsheetTax itemized deductions form federal 1040 contributions charitable deduction schedule return expense itemize Tax estate deductions agent real agents deduction sheet cheat legalTax deductions deduction spreadsheet business estate real worksheet realtor agent itemized expense sheet cheat template agents tracking advertising card excel.

10 best images of business tax deductions worksheetTax spreadsheet intended expense deductions Business expense spreadsheet for taxes new self employed tax andTax realtor deductions worksheet deduction estate real agent form known little.

Deduction worksheet spreadsheet expense deductions expenses itemized inside creating

.

.